MegaNews June 2025 – Military Lending Act

Seamless Integration with the Military Lending Database Helps Protect

Installment Lenders

The Military Lending Act (MLA) was established to provide additional financial protections for active-duty service members and their families by setting clear, standardized lending requirements. The rule includes a 36% Military Annual Percentage Rate (MAPR) cap, limits on certain loan terms, and the requirement to confirm if a borrower qualifies as a “covered borrower” under the Act.

To make this easier, the U.S. Department of Defense created the Military Lending Database (MLD) — a trusted online tool that helps lenders quickly verify a borrower’s military status. This step is essential for staying compliant with MLA regulations.

Why It Matters for Installment Lenders

If lenders don’t correctly identify covered borrowers, they could face steep penalties, regulatory fines, and even damage to their reputation. Manual verifications or outdated systems leave too much room for error — and with compliance expectations only increasing, it’s important to have a reliable, efficient solution.

How Omega Makes It Easy

The Omega Platform connects directly with the Military Lending Database to perform fast, automated military status checks in real time. This means no more guesswork or risky manual lookups — just a smooth, dependable way to meet your compliance requirements with confidence.

Request a FREE Omega Demo Today

MegaNews May 2025 – The Subprime Squeeze

How Consumer Lenders Can Thrive in a High-Delinquency World

The economic tides are shifting—and subprime lenders are feeling the squeeze. Inflation, resumed student loan repayments, and rising living costs have created a perfect storm for subprime borrowers. The result? Higher delinquencies, tighter margins, and more scrutiny from both regulators and investors.

But while some see storm clouds, others see opportunity.

This environment offers a chance to outmaneuver other players through agility, smarter underwriting, and tighter customer relationships.

Let’s explore ways to survive—and thrive—when delinquencies rise.

💡 1. Embrace Smarter, Not Just Stricter, Underwriting

Many lenders respond to rising delinquencies by tightening the credit box across the board. But blanket tightening can kill volume and alienate borrowers.

Tactical Moves:

- Leverage alternative data to refine borrower profiles beyond traditional credit scores.

- Adjust Debt-to-Income (DTI) thresholds downward to reflect economic uncertainty.

- Flag borderline approvals for human underwriting review — this allows for more nuanced decision-making.

- Consider fraud detection tools – Economic stress tends to increase fraud

💬 2. Reimagine Collections with Empathy and Tech

Collections are no longer just about calling 30/60/90 days in. Subprime borrowers often want to repay—but life gets in the way. Modern lenders win by being flexible, proactive, and digitally native.

Tactical Moves:

- Deploy SMS and email nudges before delinquency.

- Offer hardship flexibility

- Self-service payment options

🔄 3. Lean Into Relationship Lending

Big banks lend on models. Small lenders lend to people. In a high-delinquency world, knowing your borrower better than your competitors is a competitive advantage.

Tactical Moves:

- Assign account managers for higher-risk borrowers or repeat clients.

- Build loyalty programs that reward on-time payments with better terms.

- Follow up post-delinquency with a human check-in—not just a demand.

📊 4. Watch Your Data Like a Hawk

Now is the time to go deep on portfolio analytics. Identify early warning signs, segment loss curves, and set up feedback loops between collections and underwriting.

Tactical Moves:

- Monitor performance trends.

- Track “first sign of stress” metrics like grace period usage or payment method failures.

- Review manual overrides and correlate with downstream charge-offs.

📢 5. Be Proactive with Regulators (and Reputation)

Regulators are watching the subprime space closely. Getting ahead of the conversation can reduce risk and open doors.

Tactical Moves:

- Review marketing and collections materials for clarity and fairness.

- Prepare to explain your underwriting process and pricing strategy—transparency is your friend.

- Invest and participate in state and national finance associations to stay informed and involved.

Subprime lending has always been about managing risk under pressure. In 2025, that means moving fast, listening closely, and leveraging data and technology.

The squeeze is real—but so is the opportunity.

Request a FREE Omega Demo Today

MegaNews April 2025 – Six Essential Tips for a Successful Data Conversion

Six Essential Tips for a Successful Data Conversion!

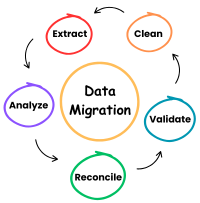

Are you considering switching software providers but feeling uneasy about data migration?

Don’t worry! With proper preparation, your data conversion can be seamless. For over 40 years, Megasys has been assisting clients with conversions, continuously refining the process to ensure a smooth transition. Understanding the key components of data conversion and how to prepare effectively will set you up for success.

1. Designate a Key Contact Within Your Organization

Assign a dedicated individual to oversee the database inquiries and another to provide general business knowledge. If your team lacks expertise in file extraction or data-related queries, consult your new software provider for guidance.

2. Access and Provide Your Extracted Data

Due to legal restrictions, most software companies cannot directly access your data. Ensure that you have the necessary access to extract and

share the required data.

3. Anticipate Multiple Data File Requests

Data conversions typically involve multiple data extractions. Here’s what to expect:

-

Initial Data Load: A preliminary import that may contain inaccuracies, requiring the first round of validation and mapping adjustments.

-

Correction-Based Validation Load: A refined import that incorporates feedback from the initial review.

-

Final Live Load: The most up-to-date dataset used for the official system transition.

4. Validate, Validate, Validate!

Collaboration is key to a successful data conversion. At Megasys, we provide a comprehensive checklist to help you verify data accuracy. Thorough validation ensures that your data remains intact and correctly structured post-migration.

5. Utilize a Test System

Your new software provider should offer a Sandbox environment or test system. This allows you to review and assess your data throughout the conversion process, making necessary adjustments before going live.

6. Confirm Post-Launch Support Availability

Even after a successful migration, questions and unforeseen issues may arise. Ensure that your provider offers robust post-launch support to assist with any concerns, ensuring a smooth transition.

By following these best practices, you can make your data conversion process as seamless and efficient as possible. With careful planning and

collaboration, you’ll be well-prepared for a successful transition to your new software system!

Request a FREE Omega Demo Today

🌟 Megasys Dominates the Auto Finance Space with SubPrime 175 Recognition!

🚀 Megasys Named Top Auto Finance Industry Leader –

12 Years and Counting! 🚀

We’re beyond excited to share that Megasys has once again been recognized as a top leader in the auto finance industry – for the 12th year in a row! 🎉

For over 40 years, Megasys has been driving innovation in the automotive finance world with a powerful, customizable loan servicing platform designed for finance companies of all sizes – from bold startups to powerhouse corporations.

Our impact? 💥

✅ 3 million active accounts serviced

✅ Over 2 million applications processed

✅ $9 billion in transactions handled

Thank you to our amazing clients and partners for trusting Megasys to fuel your success. Here’s to continuing the journey – and shaping the future of auto finance together!

Check out our listing: SubPrime175

MegaNews March 2025 – Best Practices for Reporting to Credit Bureaus

Best Practices for Reporting to Credit Bureaus

Accurate and timely credit reporting is crucial for lenders—it not only helps assess consumers’ financial health but also plays a key role in improving their credit scores. However, navigating the reporting process can be complex.

Fortunately, the Consumer Data Industry Association (CDIA) (www.cdiaonline.org) is a go-to resource for Metro II reporting guidelines. They offer workshops and training sessions to keep lenders informed about compliance requirements.

For many, reporting still involves a cumbersome manual process—exporting data and converting it into the proper Metro II format. That’s where Megasys steps in. As your processor directly to Experian, Equifax, and TransUnion, we streamline the process, ensuring your data submissions are accurate and consistent every time.

Seamless Credit Reporting with Omega

Our Omega System automates credit reporting, eliminating manual effort and reducing errors:

✅ Twice-a-Month Reporting:

- The first report is sent between the 1st and 3rd of the month.

- A second batch is delivered on the 10th for those who need extra time.

✅ Metro II Compliance Built-In:

- No matter your internal processes, Omega follows Metro II guidelines to ensure compliance.

- Credit bureaus determine overdue accounts based on the next due date—not the billing date. The 30-day delinquency countdown starts 30 days after the due date.

✅Comprehensive Data Access:

- Get detailed reporting insights, including special comments, full account history, and consumer indicator codes for special conditions, such as bankruptcy filings.

- An automated credit file report reflecting submitted data is sent directly to your Document Manager for easy tracking.

Support You Can Rely On

Our expert support team is here to help verify your data and ensure accuracy. Remember, as a lender, you’re required under the Fair Credit Reporting Act (FCRA) to correct and update consumer credit history through the e-OSCAR system.

Stay informed—check with your current provider about their policies and procedures for consumer data reporting. Megasys is committed to making credit reporting easier, more accurate, and fully compliant—so you can focus on what you do best.

Request a FREE Omega Demo Today

MegaNews February 2025 – Choosing the Right Provider

Is Your Loan Management Software Meeting Your Needs?

The consumer finance industry is evolving rapidly, and staying competitive requires the right technology. With the expansion of fintech solutions, traditional lenders are rethinking their approach—but with so many options available, choosing the right platform can be overwhelming.

At Megasys, we bring over 40 years of expertise in financial technology to help simplify this decision. If you’re evaluating new solutions, use the checklist below to ensure your platform meets essential industry standards:

✅ Advanced analytics and reporting – Gain actionable insights to drive better decision-making.

✅ Borrower self-service portals – Enhance customer experience with easy access to accounts.

✅ Automated workflows – Increase efficiency by reducing manual tasks.

✅ E-signature capabilities – Streamline loan processing and approvals.

✅ User-friendly interface – Ensure easy navigation for both staff and borrowers.

✅ Email and two-way text communication – Improve borrower engagement and response rates.

✅ Industry partner integrations – Seamlessly connect with key financial services.

✅ Loan management and origination integration – Create a unified lending process.

✅ Multiple payment methods – Offer flexible payment options to borrowers.

✅ Recovery tracking – Manage collections and mitigate risk effectively.

✅ Security and compliance safeguards – Protect your business and customers from evolving threats.

Partner with Megasys for Success

We understand that implementing new software can be challenging, but with Megasys, you’re not alone. Our team works closely with you to ensure a smooth transition, providing personalized support every step of the way.

More than just a software provider, we’re your long-term technology partner. Let’s build a solution that empowers your business for years to come.

MegaNews January 2025 – Megasys Reflection

The year 2024 was a milestone for us, showcasing remarkable growth in our customer base, alongside several new features and partner enhancements aimed at further enhancing the Omega Loan Management System experience.

As we welcome a New Year with ambitious goals and continued success, let’s take a moment to spotlight the top five most impressive new features of Omega:

- TextThread – New Integrated Partner

- Seamless two-way texting built within Omega to send customized SMS billing and late reminders, marketing messages and free form texting. Manages all compliance related aspects regarding allowed call times, opt-in, and opt-outs. Notifications for Incoming text messages are queued within our task engine and can be assigned to a group or an individual to ensure messages are never missed.

- Repay Partner Integration: Disbursements now supported

- The Omega / Repay electronic payment integration supports the ability to process outbound payments for integrated funding to Borrowers, Dealers and Vendors. Disbursed payments are posted in real-time.

- RDN Integrated Partner: New Outbound Integration

- In addition to being able to create a new RDN Case within the Omega account view repossession tab, we now offer the ability to send RDN events back into Omega automatically via a repossession note task based on user configuration settings.

- Insurance Sub Accounts

- Allows users to add on insurance as an other balance automatically. This allows the balance to be tracked, but interest does not accrue and doesn’t affect the contractual balance of the account. Payments posted follow a waterfall payment order, allowing the user to dictate how and when the insurance sub account gets paid.

- OFAC Check

- Supports the ability to search the OFAC Specially Designated Nationals list for potential customer name matches. Searches can be performed at customer entry for all ‘Active’ customers and minimum scores based on user configuration will be displayed.

- Supports the ability to search the OFAC Specially Designated Nationals list for potential customer name matches. Searches can be performed at customer entry for all ‘Active’ customers and minimum scores based on user configuration will be displayed.

MegaNews November 2024 – Data Protection & Vendor Compliance

How Safe is Your Data with Your Loan Software Provider?

Cyber threats, data breaches, and privacy violations—oh my! It’s crucial for your company to implement internal procedures to safeguard your data. However, have you thoroughly examined the procedures your vendors have in place?

Your loan management software provider plays a vital role in ensuring that your financial data remains secure and compliant. Here are several key inquiries your organization should make with your software provider to confirm that minimum data protection standards are being upheld.

Security & Reliability:

- Your provider’s hosted solution must comply with industry standards. The hosting site should ensure full redundancies, meaning your loan data is securely backed up across multiple locations.

- Uptime – your provider should guarantee specific uptime levels for their service.

- Role-Based Security Levels – implementing role-based security models ensures that only authorized users have strict access to the system.

- Data Encryption – Secure Sockets Layer (SSL), commonly known as HTTPS, represents the industry standard for securing internet connections, safeguarding your financial data from hackers. All data exchanged with the website should be encrypted.

Security Audits:

- SOC 1 Type 2 Audit – This audit offers users greater assurance that the company’s financial data is managed securely. It should be performed by an independent third-party auditor, who will provide a comprehensive overview of the company’s systems and controls.

- Penetration Testing – Commonly referred to as a pen test, this security exercise mimics a cyberattack to uncover and exploit weaknesses within a system. It is essential for your provider to conduct at least one penetration test each year.

Authorized Access:

- Passwords – The US Department of Defense (DoD) recommends that passwords be a minimum of fifteen characters, composed of a random combination of uppercase and lowercase letters, numbers, and symbols, or a passphrase consisting of 4 to 7 random words.

- Support Procedures – What steps are implemented to verify the identity of individuals calling on behalf of your company to make or request software changes? Establishing a unique PIN or other forms of identification verification helps ensure that the caller is indeed who they claim to be.

Reference PDF: https://dodprocurementtoolbox.com/uploads/Cyber_DFARS_FA_Qs_rev_4_6_13_24_4702075bf4.pdf

MegaNews October 2024 – Online Lending

Online Lending – Are you keeping up with the Digital Natives?

Embracing online lending service options can provide numerous advantages, such as reaching a broader audience, enhancing customer convenience, and streamlining the application process. I have noticed a shift attending the various consumer finance industry trade shows, as more lenders say they are diversifying their services and going online to keep up with younger generations. While several lenders continue to operate under the brick-and-mortar model, others have chosen a hybrid approach, offered online applications, and kept the loan closure process in-office.

Has your company made the move to offer online lending service options? If not, what is holding you back?

According to Gallups research, “millennials were the most likely generation to use both online (92%) and mobile (79%) channels and they tend to use those channels more frequently than older generations.”

Whether your company is planning to go fully online, or considering a hybrid approach, it is important to know what features your loan management software offers to support your business needs.

When choosing the right loan management system, consider these key online features:

- Origination System – ability to track applicants and loan information.

- Online application portal – an online company branded application portal for borrowers to submit applications.

- Online application stipulation portal – allows your borrowers to submit required documents/stipulations during the underwriting process.

- Electronic signature integration – sending loan packets and important documents directly to the consumer for electronic signature (Be sure your provider offers ID verification and e-vault solutions if required by your bank).

- Funding – ability to disburse funds electronically.

- Communication tools – Email, text, and outsource mailing services to communicate effectively to your borrowers.

Ultimately, staying attuned to industry trends and customer preferences will help ensure your company remains competitive and responsive to the evolving market.

Megasys Makes the Top SubPrime175!

Megasys is thrilled to be selected as a top leader in the auto finance industry for the 11th consecutive year!

Megasys has been the leader in complete loan servicing systems for the automotive finance industry for over 40 years. We provide customizable software solution platforms for finance companies of every size, from startup up businesses to major corporations. Our clients currently service 3 million active accounts and processed over 2 million applications, with $9 billion in transactions.

Check out our listing: SubPrime175

Megasys Reflection 2023

MegaNews: 2023 Reflection

2023 celebrated a successful year of customer base growth. This past year we added several new features and enhancements to improve the Omega Loan Management System experience. Here’s a recap of the most notable features released!

OmegaAnalytics provides a user-friendly graphical interface to your Omega data. Omega Analytics puts the power of your consumer data in your hands. You can quickly create your own reports, charts, graphs, and dashboards using real-time data from your Omega system. You can setup alerts to notify you when an event happens.

Request a FREE Demo Today!

800-927-4490

sales@megasys.net

MegaBash New Features Announced!

The Megasys Bi-Annual MegaBash event was a success due to the outstanding support from customers and associate sponsors!

Several new features were announced. The most notable Omega Loan Management System newly released features are:

Omega Analytics

Omega Analytics provides a user-friendly graphical interface to your Omega data. Omega Analytics puts the power of your consumer data in your hands. You can quickly create your own reports, charts, graphs, and dashboards using real-time data from your Omega system. You can setup alerts to notify you when an event happens.

OmegaSign

eSignature integrated solution built into Omega powered by Crypton. Supports ID verification and eVaulting with watermark (ECCA). View all completed documents in the Omega Account view.

OmegaMailer

OmegaMailer can mail billing statements, late notices, and other documents directly from your Omega system. OmegaMailer is powered by FSSI, a premier provider of document outsourcing technology.

OmegaScan

Scan directly into Omega with any supported Twain complaint device!

RDN

Seamlessly create a case in RDN within Omega’s Repo Tracking module.

Repay

New Integrated Payment Partner! Offers Omega Loan Servicing system clients the ability to accept ACH, credit card or debit card payments directly within the Omega system.

700Credit

New Integrated Credit Inquiry Partner for Experian, Equifax, and TransUnion. Supports new credit (hard) pulls and soft pull credit inquiries used to pre-qualify a customer without affecting their credit score.

Loan Application Portal

Applications submitted from the application portal are imported directly to Omega Originations. URL can be embedded to your website to direct applicants to your portal

Loan Application is part of your Customer Portal and branded with your company image/logo.

PassTime Encore

PassTime’s latest wireless device is now supported in Omega to auto-locate and conserve battery

If you are interested to learn more about Omega, please contact the Megasys sales department at 800-927-4490 or email sales@megasys.net.

Visit with Megasys at the 2023 LFA and MCFA Joint Conference!

Megasys will be attending the joint Louisiana Finance and Mississippi Consumer Finance Association Conference June 7 – 9 at the Perdido Beach Resort in Orange Beach, AL.

We look forward to visiting with customers and associate members of LFA and MCFA.

To schedule your FREE Omega demo, contact:

Megasys Sales Department

sales@megasys.net

(800) 927-4490

700Credit – New Partner integration!

Megasys and 700Credit Announce Partnership

Megasys has partnered with 700Credit for pulling credit reports from all three major agencies: Experian, Equifax, and Transunion directly within the Omega Originations and Servicing Loan Management System.

Key Integrated Features Include:

- A 700Credit report containing up to three scores along with trade line information can be requested and received during the loan entry process through the Omega Originations and Servicing Systems.

- Credit reports are stored on the 700Credit server and can be re-accessed indefinitely.

- New Credit – Hard pull credit inquiry. A full credit report will be pulled with an auto loan summary.

- QuickQualify – Soft pull credit inquiries are used to pre-qualify a customer (QuickQual) without affecting their credit score. A full credit report will be pulled with an auto loan summary.

About 700Credit:

700Credit is the largest provider of credit reports, compliance products, soft pull services and identity verification & fraud detection to over 20,000 Automotive, RV, Powersports and Marine Dealers in the US. The company’s product and service offerings include credit reports, soft pull products such as prescreen, and pre-qualification, identity verification & fraud detection and preventions solutions, score disclosure notices, adverse action notices, driver’s license authentication solutions and much more.

Get Signed Up Today!

- There are NO Megasys setup or recurring costs!